Automation of Inclearing Return Items - A Case Study

Executive Summary

While check volumes in the U.S. have been steadily decreasing over the last 20 years, even at today’s volume, more than $86 Billion in transit items are returned to Banks of First Deposit (BOFD) each year. The introduction of image processing to the clearing of checks has increased the efficiency of the exchange system such that the Federal Reserve Bank now processes all checks at a single location eliminating the concept of a “nonlocal” check, reducing the clearance time and the opportunities for holds on deposited funds. These changes require that returned transit returns be processed as efficiently and expediently as possible to reduce risk of financial loss.

In 2014, All My Papers (AMP) was approached by a large regional financial institution seeking help to automate their transit check image return processing. Even though the Bank had adopted check imaging for exchange early in Check 21 era, their transit item return processing system was still largely paper-based. This system, which made use of printing and re-imaging of check items, physical routing of paper and use of disparate in-house generated computer applications did not scale well as the Bank grew.

Recognizing that change was required, the Bank developed a list of its goals for an improved transit returns system that would be faster, more accurate, cost-effective and provide improved fraudulent item detection. A system meeting the Bank’s goals needed to be accomplished in less than a year; within a limited budget; and be completed with minimal disruption to the Bank’s existing workflows.

The Bank looked at in-house development as well as off the shelf commercial solutions. While several companies appeared viable, their proposals could only partly fulfill the list of the Bank’s "must have” requirements in the timeframe and budget required.

The Bank approached All My Papers (AMP) with its list of requirements which resulted in a detailed specification that was used by the Bank to solicit bids from several vendors including AMP who was eventually selected to provide a solution. The AMP product, called X9 Returns, was delivered within budget, put into production within 7 months of contract signing and delivered the many benefits to the Bank including:

- Interfaced with the Bank’s existing item processing software

- Reduced Fraud

- Reduced time to process returns and exposure to loss

- Increased the accuracy of the return process

- Maintained historical workflow patterns to minimize organizational disruption

- Simplified processing

- Provided enhanced security

- Reduced technology risks by utilizing an industry standards based solution

- Enabled the Bank to implement redundancy and physical dispersal of the product using bank’s existing IT infrastructure.

- Reduced the Bank’s reserve requirements with improved bottom line results

Check Returns in the U.S.

The 2013 Federal Reserve Payments Study showed that the overall rate of checks returned unpaid decreased to .41% in 2012. The average dollar value of these items amounted to $1,224. Even at today’s check volumes, this represents more than $86 Billion in transit returns.

The introduction of image processing to the clearing of checks over these last 10 years has resulted in a very efficient and expedient means of presenting deposited items from a Bank of First Deposit to the Paying Bank for payment. In early 2010, the Federal Reserve Banks decreased their processing offices to a single location, thus eliminating the “nonlocal” check. This reduced the number of days a depository institution could place a hold on deposited funds. Further, in an attempt to provide increased customer service, many financial institutions have made deposited funds available on the next business day.

The above changes and actions require that transit returns be processed as efficiently and expediently as possible to reduce risk of financial loss.

The Client Requiring Change

In 2014, All My Papers (AMP) was approached by a large regional financial institution (the Bank) seeking help to automate their transit check image return processing. Even though the Bank had adopted check imaging for exchange early in Check 21 era, their transit item return processing system was still largely paper-based. This hybrid system made extensive use of printing and re-imaging of check items in conjunction with physical routing of paper items and usage of disparate in-house generated computer applications. While it had served the Bank for almost 10-years, as the business grew, so did the volume of returns. By the end of 2014, returned transit item volume was becoming unmanageable and, in particular, experiencing an increase in fraudulent items.

The Client’s Challenge

The following workflow and description will highlight the labor-intensive and redundant steps that challenged the Bank’s ability to achieve a cost effective and efficient environment.

Bank’s Existing Transit Returns System

Description of the processing flow

Description of the processing flow

- Bank receives an ICLR file containing returned transit items that are then printed as paper “check-like” documents and manually stamped with a unique sequence number.

- Paper items are physically sent to various departments in the Bank for disposition where employees would research items to determine the account holder by matching the returned item to a depositor account number, etc.

- Employees would manually review each item to identify those eligible for redeposit and create the necessary accounting entries to reverse the deposit and initiate a redeposit process.

- Redeposited items would then be image scanned and incorporated into that day’s outbound ICL file for re-presentment to the payor bank via the exchange system.

- The physical transfer of returned items between work groups included Savings, Checking, Credit Card, Mortgage, IRA, Loan as well as the security investigation and collection departments. All transfer steps between departments were tracked and balanced by General ledger accounting entries. Since the next steps in the collection process would likely require a check image, these items would be rescanned from paper to images.

- Items not re-deposited would be entered as reversing entries against the depositor’s account and a negotiable return IRD would be printed and sent back to the depositor accompanying the return notification letter.

The system worked reasonably well for the Bank when the volume of returns was much smaller, but due to the time required to print, route and re-scan check items, it lacked scalability. Over the years, the organization grew as a result of the increased volume of returns to the point that the workload outstripped the system’s ability to promptly and accurately process returns.

Fraudulent item detection and mitigation was becoming a significantly larger and larger issue. Opportunities for fraud were increasing with the advent of electronic payments e.g. ATM’s and mobile deposits. The volume of potentially fraudulent items grew until the processing for these items reached a processing cycle time of 5 days or more. Many of the smaller value items were written off without being addressed since the Bank could not identify a favorable return on investment for a new or upgraded core and/or item processing system.

Client Requirements

Recognizing that change was required, the Bank developed a list of its goals for an improved transit returns system that would be faster, more accurate, cost-effective and provide improved fraudulent item detection. These included:

- Accelerating the entire process so that identification and resolution could take place while the fraudulent check trail was current and in compliance with Regulation J, Regulation CC and other clearing agreements such as ECCHO Rules.

- Establishing a readily available data archive with several years of deposited item transactions that could be searched to develop payor account “black lists”.

- Improving the recognition efficiency of dollar amounts and account numbers when matching returns to the previous outgoing items.

- Maintaining current internal workflow - return processors do not have to learn a totally new way of doing things.

- Complete elimination of paper and associated repeated conversions between paper and check images, thus retaining them in the electronic domain throughout the system.

- Elimination of the physical movement of paper copies of checks.

- Perform automatic identification of eligible re-deposit items and automatic routing of these items to the outbound exchange queue.

- Perform automatic matching of return items to source (depositor and other accounts).

- Provide on-screen viewing and disposition of non-redeposit items by the target departments.

- Automatically create notification letters with attached negotiable IRDs for the return of dishonored items to depositors.

- Provide the ability to configure workflows without having to reprogram either the transit returns system or the Bank’s core processing software.

- Provide robust user access control with roles and responsibilities that are independent of host system but use a single sign-on

- Post reversal and other transactions to depositor and general ledger accounts.

- Mitigate the risk of obsolescence by basing the system on standardized platform independent technologies and ICL/ICLR files

- Provide for both Redundancy and Physical Dispersal using standard files, data bases and operating systems to meet various regulatory requirements, including FFIEC and the OCC (Office of the Comptroller of the Currency).

Sourcing a Solution

A system meeting the Bank’s goals needed to be accomplished in a less than a year; within a limited budget; and be completed with minimal disruption to the Bank’s existing workflows. The budget requirements also precluded replacement/upgrade of the Bank’s Core and/or Item processing systems and also precluded upgraded versions of the Bank’s Core and/or Item processing systems.

The Bank first looked inside itself and considered in-house development but no strong candidate solutions were proposed.

They then looked at off the shelf commercial solutions including those from check processing system vendors. While several companies appeared viable, their proposals, even with modifications, could only partly fulfill the list of the Bank’s "must have” requirements in the timeframe and budget required.

The Bank then approached All My Papers (AMP) with its list of requirements. AMP proposed, as the first step, a full review of the requirements document completed via both onsite and phone conference discussions by one of AMP’s senior designers, who has an industry wide reputation. The result was a detailed specification that that became the blueprint for development of the X9 Returns solution for the Bank.

The AMP Solution

The AMP product, X9 Returns, is an application with features that:

- Interfaced with the Bank’s existing core and item processing systems

- Eliminated manual balancing and tracking of items between workflow nodes by automating most former manual and error-prone processes, such as making GL entries from spreadsheets.

- Allowed key personnel involved in the transit returns process to continue performing their jobs in a familiar manner, retaining its basic existing workflows – albeit, in a more electronic manner. This last characteristic was a big win for the organization in gaining user acceptance for the new system.

- Provided a robust configurable system of user roles and responsibilities that facilitated the assignment of operators, addition of departments, etc. without reprogramming and using existing authentication and authorizations system via a single sign-on.

- Combined the above features with the elimination of the physical transport of paper copies of checks and provided the Bank with a much greater degree of latitude to enable the geographic dispersion of personnel

Further, rather than being based on in-house developed applications, X9 Returns was constructed using standards designed to meeting ongoing industry requirements. These include:

- SQL database to store check item data and business rules/procedures

- Industry Standard ASC X9 ICL files for external exchange and internal interface

- SOAP standards for real-time data interchange between disparate technology platforms

- XML files for system configuration

- TIFF format for storage of check images

- Commercially available web Browsers for user interface presentation

The AMP Implementation

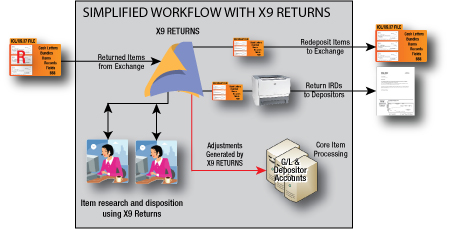

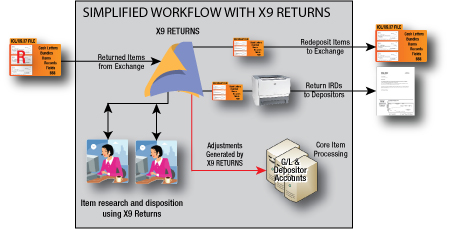

The following workflow and description will highlight how the AMP X9 Returns system and its interface with the Bank’s core and item processing systems significantly reduced the labor-intensive and redundant steps that challenged the Bank’s inability to achieve a cost effective and efficient environment.

AMP X9 Returns System for Transit Returns

Simplified Returns Processing

While the basic design of the legacy system’s workflow has been retained, many manual steps have been removed to simplify the system:

- Incoming return items and items eligible for re-presentment are no longer printed to paper, thus, eliminating the use of printers, toner, paper and printer maintenance, as well as the attendant for paper loading and check image unloading.

- Physical transport of return items within and between departments is eliminated.

- Human intervention is not required for the identification; physical routing; and rescanning of redeposit items, thus, eliminating both time and errors resulting from review of endorsement stamps.

- Rescanning of paper is eliminated.

- Automatic generation of negotiable IRDs and advice letters for items being returned to depositors is enabled.

- Real-time interface to the Bank’s core applications for intraday placement of hold on funds for items requiring further action or direct debit to depositor or general ledger accounts.

Under the old system, regardless of the ultimate disposition of a returned item information from each item was transcribed by operators from the printed check into one of the many legacy Bank systems for either research or data entry. The automatic routing within X9 Returns eliminated all manual re-keying of information, thus, reducing time and errors. This also eliminated the need for external system controls to balance and track items throughout the workflow nodes adding to the savings of time and money.

Faster Returned Item Cycle Time

Faster cycle times for return item processing equates to reduced costs and risk of financial loss.

- When a check is returned, the Fed debits the BOFD’s account and credits the payor bank account. If the item is eligible for re-deposit, the sooner it is re-cleared, the sooner the BOFD will again be credited for that item.

- Losses on returned items can be reduced by immediately debiting the item to the customer account or at least placing a one-day hold on the funds. This reduces the possibility of releasing funds against items that have been returned.

- Banks must maintain reserve requirements for return items based on the aggregate value of those items not finally debited to a customer or other account. Faster cycle times to initiate a customer account chargeback or the re-deposit of an item reduces the dollar value of outstanding returns, thus, reducing the required reserve requirements.

Improved Accuracy

X9 Returns eliminated the former manual and error prone method of associating each return item with its deposit source. The former method required visual inspection of the rear of the check printed in the department for a deposit account number. This affected the Bank in several ways:

- The time required to perform a match and then create a reversing entry in the depositor’s account meant that the Bank lost the use of funds on the returned item until a match could be completed.

- Matching a depositor’s account from the endorsement on the back of the check often resulted in errors because the information was difficult to read because there is no enforceable standard on the placement of endorsements and often resulted in overlapping endorsements. For those items bearing only electronic endorsements, the rear of the check becomes useless and extensive research is required.

- An error in reading or transcribing the account number results in: the wrong depositor’s account would be debited; the wrong amount would be debited; or that no matching account could be found thus causing customer service issues and/or the Bank would have to write off the amount of the item.

With X9 Returns, the depositor’s account number is stored in the system’s archive and linked to the outbound item as it was sent in the forward presentment file to the Fed. Upon return, it will be automatically matched to and debited from the depositor’s or other account within a few minutes of receiving the return file.

Reduced Check Fraud

X9 Returns will accumulate and maintain several years of transit return item information that can be searched to create payor account “black lists” identifying account holders of deposited items that had previous fraudulent items or items returned for other reasons. The former process provided no way to quickly identify a potential problem item and caused the bank to incur the Day 1 and Day 2 payment obligations to its depositors. With X9 Returns, checks drawn against “black listed” accounts can be spotted on Day 0 prior to that day’s forward presentment file presented for collection. Security or other departments might then perform diligence on the item prior to the Bank’s Day 1 and Day 2 payment obligation deadlines and, if justified, apply additional days hold on funds.

Improved Operational Flexibility

The Bank’s legacy transit return system relied on the transport of printed paper items for interdepartmental routing. Because of this, the physical proximity of the satellite departments was limited in order to keep processing cycle times as short as possible.

With X9 Returns, all interdepartmental routing is accomplished over the Bank’s network making routing nearly instantaneous. System operators now can be located anywhere within the reach of the Bank’s network. User roles and responsibilities can be assigned to individual users via configuration files with no need for the involvement of technology staff or need to include the core or item processing systems.

Enhanced Security

User roles restrict exposure of customer information and ability to route sensitive transactions only to those with proper authorization to view/create transactions.

Since check items are no longer rendered as paper, there is less opportunity for unauthorized parties to access them, thus reducing the likelihood of theft. This also eliminates the need for physical security and secure disposal of the items printed during processing.

Minimal Disruption

X9 Returns, while automating many former manual tasks, follows the workflow steps of the Bank’s legacy transit return processing system. Therefore, minimizing organizational disruption and reducing the operator learning curve during the transition.

X9 Returns required a minimal change to the item processing system to include the customer or other source account information in the forward presentment ICL file in order to ingest that information into the X9 Returns system for use when an item is returned.

X9 Returns was able to perform real-time communication with the Bank’s mainframe and other IT resources using SOAP standards for data interchange, which was already widely adopted by the bank. This allowed for initiation of intra-day holds on funds and debiting of depositor or other source accounts.

Reduced Technology Risk

While no technology is immune to obsolescence, the Bank sought to reduce this risk by selecting a solution that used widely deployed and well accepted technologies. X9 Returns is built on industry standards based technologies:

- Reads and writes ICL/ICLR files - the native format for check exchange

- Check images are stored as TIFF images

- Data storage is within a SQL database allowing for use of a wide range of tools including ODBC compliant reporting and standard business intelligence tools for reporting

- User interface presentation via HTML and standard browsers eliminating the need for a proprietary client.

- SOAP standards for data interchange between the Bank’s various technologies platforms

Summary

AMP was able to provide the Bank with a feature-rich transit item return processing system that worked seamlessly with the Bank’s Core and Item Processing systems and adhered to the Bank’s existing workflows. As a result, time and cost of implementation were minimized; major disruption of a switching to a new system was avoided; and the benefits of an automated ICL file based system were delivered.

X9 Returns Workflow

X9 Returns

- Interfaces with a Bank’s existing item processing software

- Reduces Fraud

- Reduces time to process returns and exposure to loss

- Increases accuracy of the return process

- Maintains current workflows with minimal disruption to the organization

- Simplifies processing

- Provides enhanced security

- Utilizes industry standards based solutions vs proprietary solutions

- Reduces technology risks

- Implements within a Bank’s target timeline and budget

- Provides both Redundancy and Physical Dispersal using bank standard systems

- Reduces reserve requirements with improved bottom line results

Contact All My Papers

Contact All My Papers to automate check Image Cash Letter (ICL) file processing.