Disclaimer: This article is not intended as legal or compliance advice, and if legal advice is needed, the opinion of a competent attorney should be sought.

Last month’s article provided a brief overview of the Regulation CC[1] Amendments - effective July 1, 2018. This article briefly identifies some of the operational considerations of those provisions.

Expeditious Return Rule

The regulation provides protection to the Paying Bank for a late return if the Depositary Bank does not have an electronic connection to receive returns through a “commercially reasonable” means. The Regulation does not define “commercially reasonable”, but it is likely that returns received directly from paying banks or returns received from the Federal Reserve or from a known image exchange network would meet the definition. A Depositary Bank should have an electronic connection for the receipt of returns. The determination of whether the return was received electronically through a commercially reasonable means is dependent on the facts of each situation and the burden of proof is on the Depositary Bank. Both the Notice of Nonpayment and return of the item are now required to be received by the Depositary Bank by 2:00 p.m. (previously 4:00 p.m.) local time of the Depositary Bank; this change in deadline is not expected to have negative impacts on banks. The Notice of Non-Payment was retained by Reg CC with changes[2], but as in the past, the Notice is not required if the return would be received by the Depositary Bank within the new Reg CC receipt deadline. Banks should evaluate the need for these notices.

Electronic Check and Electronic Returned Checks

It is unlikely the Electronic Check and Electronic Returned Check provisions will have any significant operational impacts. Most checks are already being exchanged as images. Banks need to ensure they have comprehensive image exchange agreements in place. Banks exchanging images through the Federal Reserve are governed by Regulation J and Operating Circular 3 (OC3). Many private sector exchanges are governed by the ECCHO Rules. Regardless of the image exchange network used, agreements are now required by Regulation CC.

Electronically Created Items (ECIs)

The ECI indemnity protects banks receiving ECIs from losses due to the receipt of an ECI [similar to Check 21 protections]. The Fed indicated these items cannot be distinguished from images derived from paper checks, however, software is available that can identify ECIs and ECIs are currently being exchanged through the check image system. Since ECIs are not checks under Reg CC, the expeditious return requirement, as well as other Reg CC provisions do not apply; ECIs can be returned after the two-day test. Exchanges can make their own decisions on eligibility of ECIs going through their image exchange network. A bank can make an indemnity claim to the Depositary Bank for losses associated with ECIs and then allocate those losses to its customer. A claim letter is likely how this claim will be made.

RDC Indemnity

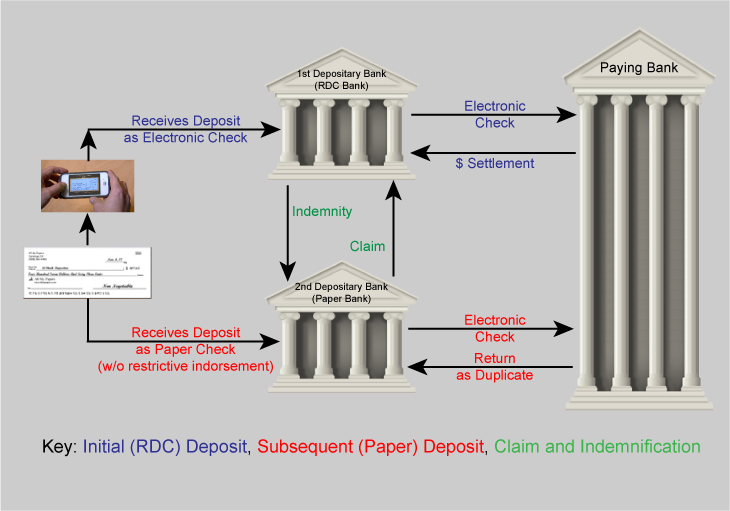

The Reg CC RDC indemnification creates some new operational considerations for each bank (see pictorial below).

The 1st Depositary Bank (RDC Bank) makes the indemnity when the conditions (see the previous article for those conditions) in the Regulation are met. Depositary banks should update their RDC agreements requiring customers to provide restrictive indorsements on deposits and provide education to its customers about this change. Banks may choose to implement software to identify the presence and/or the type of indorsements on RDC items. The RDC Bank must expect, accept and pay claims from other Depositary Banks, even banks with which they have no relationship.

The Paying Bank will handle duplicates as they do today either by returning or adjusting them to the first or second Depositary Bank. If a duplicate is returned to the 2nd Depositary Bank (who received a paper deposit – the “Paper Bank”) it is likely that the 2nd Depositary Bank will request information regarding the identification of the 1st Depositary Bank. These requests must be responded to within the time required by the adjustment type.

The 2nd Depositary Bank (Paper Bank) will determine if it has a claim, which would be made to the 1st Depositary Bank. In some situations, these claims can be made through an adjustment process (Fed or ECCHO Rules), while in other situations claims will be made by a claim letter. Industry groups are developing sample claim letters.

The last article described the below scenario.

It is possible that more than one RDC Bank is involved; all RDC Banks make the indemnity to the Paper Bank who can make a claim to any RDC Bank. See below for pictorial representation.

------

[1] A copy of the final rule can be obtained at https://www.gpo.gov/fdsys/pkg/FR-2017-06-15/pdf/2017-11379.pdf.

[2] Changes included new dollar limit of $5,000 (previously $2,500) and deadline of 2:00 p.m. (previously 4:00 p.m.).