Disclaimer: This article is not intended as legal or compliance advice, and if legal advice is needed, the opinion of a competent attorney should be sought.

On May 31, 2017, the Federal Reserve released its long awaited final rule on amendments to Regulation CC[1] , effective July 1, 2018. The rule encourages electronification of image returns and includes other important provisions.

Expeditious Return Rule

The new expeditious return rule requires all returned checks, both paper and electronic, to satisfy a modified “two-day test” for expeditious return. All checks must be returned to the depositary bank (i.e., BOFD) either directly or through a returning bank, such that the return would normally be received no later than 2:00 p.m. (depositary bank local time) on the second day following the day on which the check was presented to the paying bank; the current deadline is 4:00 p.m. The regulation provides protection to the paying bank for a late return if the depositary bank does not have an electronic connection through a “commercially reasonable” means; this encourages depositary banks to accept electronic returns. The Notice of Non-Payment was retained with a new dollar limit of $5,000 (previously $2,500) and a deadline of 2:00 p.m. See below for pictorial representation.

Electronic Checks and Electronic Returned Checks

Electronic check and electronic returned check (electronic check) are defined as an electronic image and electronic information derived from a paper check under an agreement between the sending and receiving banks (does not convey the right to send an electronic check absent an agreement) and conforms with ANS X9.100-187.

The use of “derived” is meant to clarify that the image must be created from a paper item. Electronic checks are subject to Regulation CC, Subpart C and treated the same as paper checks for all purposes. The final rule adopts new warranties that apply only to electronic checks. Under these warranties, each bank that transfers or presents an electronic check warrants that the electronic image accurately represents all the information on the front and back of the original check at the time the original check was truncated, that all the electronic information is accurate, and that no one will be asked to pay the item twice. These warranties extend to other banks and to the drawer/owner of the check.

Electronically Created Items (ECIs)

ECIs are electronic images that have all the attributes of electronic checks but that were created electronically and not derived from paper checks. They never existed in paper form and does not meet the definition of electronic checks. The new ECI provision indemnifies for losses caused by - ECIs not derived from a paper check (which could include Reg E losses), ECIs not authorized by the account holder or a bank paying an item that it has already paid. The indemnity shifts losses to the depositary bank. ECIs are not “electronic checks” under Reg CC and are not subject to other provisions of Reg CC. The Reg CC ECI indemnity addresses some considerations but leaves questions of eligibility of ECIs to rule sets by agreement (e.g., ECCHO, OC3).

RDC Indemnity

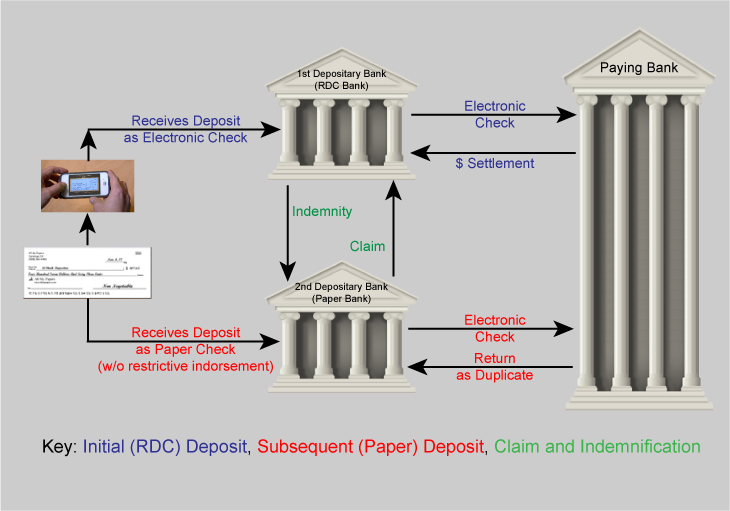

The new RDC indemnity protects a second depositary bank that receives a deposit of a paper check that was returned unpaid after the check was previously deposited at another bank using RDC. The indemnity is provided by the first depositary bank that: 1) is the truncating bank because it accepts deposit of an image related to the original check; 2) does not receive the original check; 3) receives settlement; and 4) does not receive a return of the check unpaid. The first depositary bank indemnifies the second depositary bank that accepts the original check for deposit for losses incurred if the loss is due to the check having already been paid. But the first depositary bank does not make the indemnity if the original check bears a restrictive indorsement inconsistent with the means of deposit. The first depositary bank’s potential liability arises when it permits the customer to truncate the paper check and deposit the image. See below for pictorial representation.

The next article will discuss the operational implications of these provisions.

Phyllis C Meyerson, CCM, AAP, NCP can be reached via email at phylliscmeyerson@gmail.com or by phone at (972)333-9626.

-------

[1] A copy of the final rule can be obtained at https://www.gpo.gov/fdsys/pkg/FR-2017-06-15/pdf/2017-11379.pdf.